Small Business Budgeting

$0.99

Small Business Budgeting is your step-by-step guide to taking control of your business finances and building a resilient, profit-driven operation. This 40-page ebook is packed with practical advice for entrepreneurs and small business owners who want to create budgets that work, forecast revenue, cut costs strategically, and use modern financial tools to automate decision-making.

From budgeting fundamentals to advanced forecasting, cost control strategies, and choosing the right software, this book offers real-world examples and detailed guidance to help you build a business that’s not just sustainable—but scalable.

Pages: 40

File: PDF

Released: 04/20/2025

Small Business Budgeting: Create Smart Budgets, Forecast Revenue & Control Costs with Confidence

In business, cash flow is king—and budgeting is your map. Small Business Budgeting is a 40-page, actionable guide for entrepreneurs, freelancers, and business owners who want to take command of their financial future. Whether you’re starting your first business or scaling your current operation, this book provides a comprehensive framework for managing money with clarity and strategy.

You don’t need to be a financial expert to master your business budget. This guide breaks everything down step-by-step—from essential budgeting terms to advanced forecasting methods, cost control, and selecting the right tools for ongoing success.

You will learn how to:

📚 Master key financial concepts like revenue, profit margin, cash flow, and break-even analysis

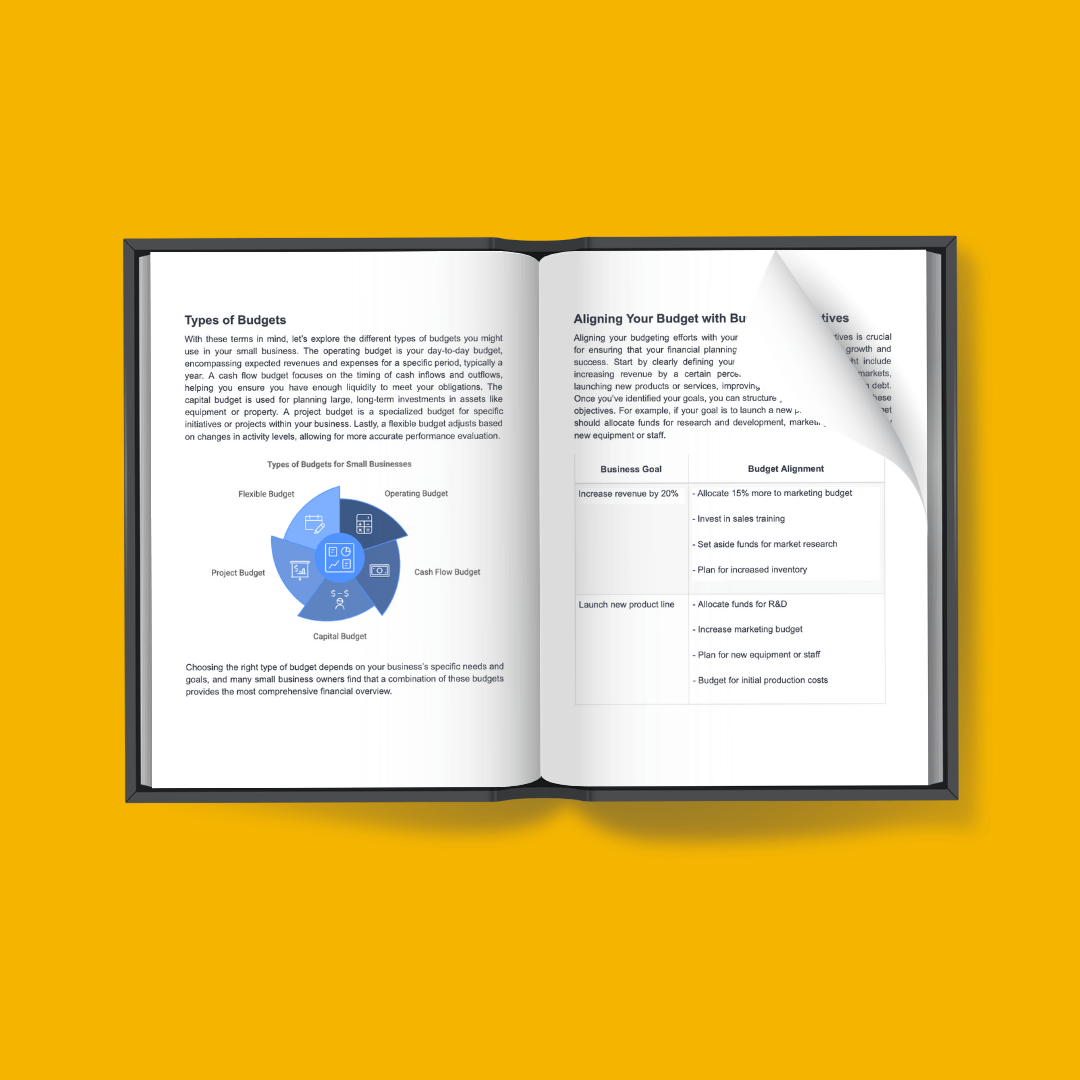

🗂️ Choose between different budget types—operating, capital, project, and flexible—and apply them strategically

📈 Align your budget with specific business objectives like increasing revenue, launching new products, or expanding to new markets

🧮 Build your first budget with a 12-step process that includes revenue forecasting, expense planning, and cash flow management

📊 Implement advanced budgeting methods like zero-based budgeting and scenario planning for multiple business outcomes

🛠️ Track, control, and reduce costs using lean management, negotiation tactics, and innovative tech solutions

📉 Perform cost-benefit analysis and break-even calculations to make smarter investment decisions

📥 Improve forecasting accuracy using qualitative and quantitative methods—including regression analysis and pipeline modeling

💻 Select and integrate financial tools like QuickBooks, Xero, Float, PlanGuru, and others that scale with your business

🔐 Implement security, automation, and team access best practices while protecting your financial data

Whether you manage a storefront, run a service-based company, or are bootstrapping a startup, Small Business Budgeting will empower you to create accurate, flexible financial plans that give you peace of mind—and set the stage for growth.