Angel Investing

$0.99

Angel Investing is your step-by-step guide to evaluating, funding, and supporting startups as a private investor. This 38-page ebook provides the strategic, legal, and emotional frameworks you need to succeed in the fast-paced world of early-stage investing.

Learn how to spot promising founders, perform due diligence, negotiate fair terms, and structure deals that balance risk and return. Whether you’re new to startup investing or looking to refine your approach, this guide gives you practical tools to diversify your portfolio and back innovations with high-growth potential.

Pages: 38

File: PDF

Released: 04/12/2025

Angel Investing: How to Evaluate Startups, Structure Deals, and Support Entrepreneurs for Long-Term Growth

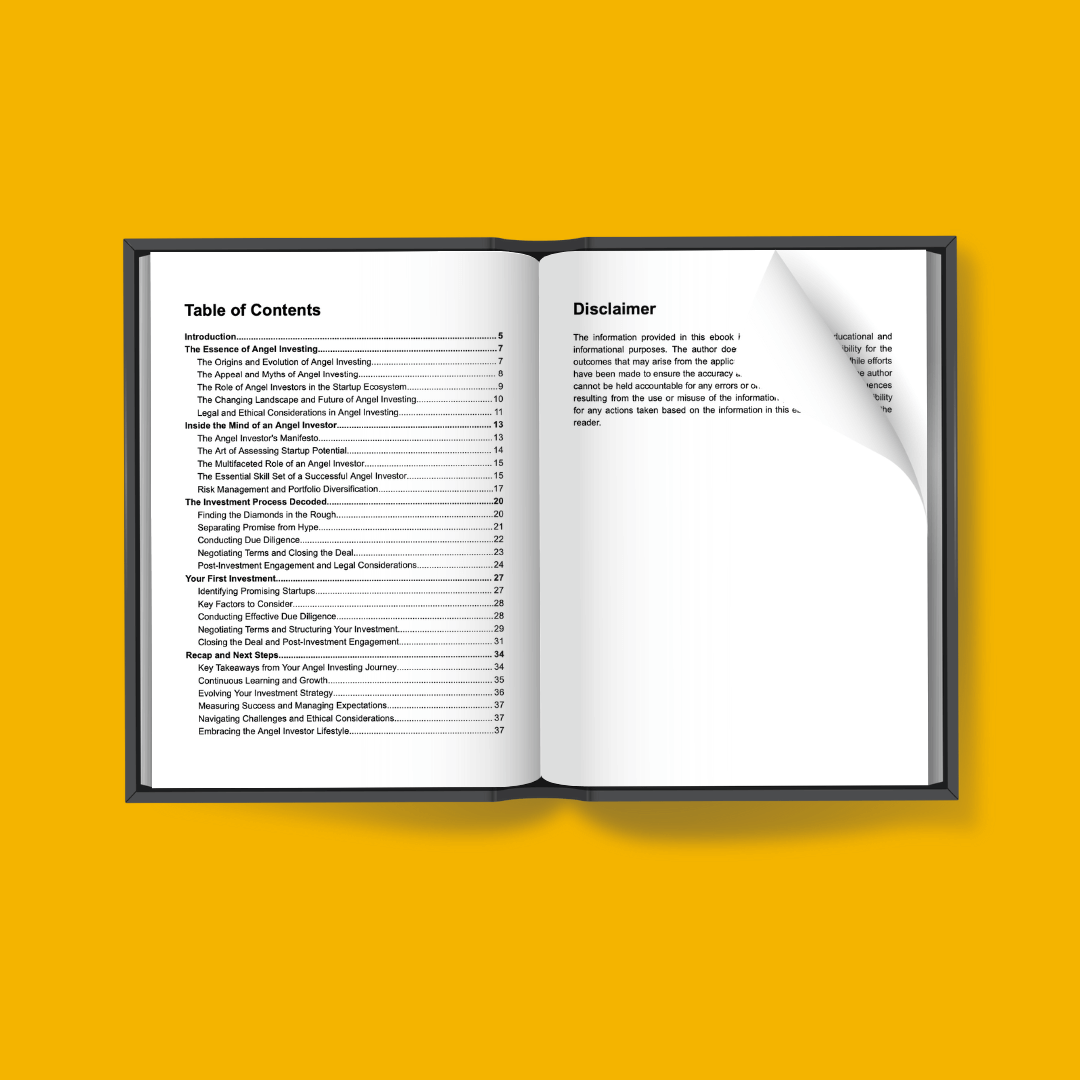

Angel investing isn’t just about putting money into a startup—it’s about shaping the future of innovation while managing risk with strategic discipline. Angel Investing is a 38-page practical playbook for individuals ready to participate in the startup ecosystem as early-stage backers, mentors, and growth partners.

From understanding what makes a startup fundable to negotiating smart deals and adding value beyond capital, this guide prepares you to invest with confidence. You’ll explore every stage of the angel investing journey, including sourcing deals, evaluating founders, conducting due diligence, understanding equity structures, and building a diversified portfolio that reflects your financial goals and values.

You will learn how to:

💡 Understand the fundamentals of angel investing and your role in the startup ecosystem

📈 Evaluate startups using frameworks for market size, product-market fit, and founder quality

🧠 Think like an investor—balancing vision, risk, and data-driven analysis

📋 Conduct due diligence on founders, financials, traction, legal standing, and technology claims

💼 Negotiate fair terms using SAFE notes, convertible debt, or equity deals

📊 Diversify your portfolio and manage exposure across industries and stages

📞 Support startups post-investment with mentorship, strategic guidance, and connections

⚖️ Navigate legal and ethical responsibilities, including accredited investor guidelines

🧭 Create a long-term investment strategy that balances profit, impact, and personal interest

🚀 Prepare for exits and know how to evaluate M&A, IPOs, and follow-on funding rounds

Angel Investing also explores mindset mastery—helping you manage the emotional ups and downs, avoid common pitfalls, and cultivate the patience and curiosity required to thrive as an angel investor. Whether you’re investing $5K or $50K, your first deal or your fifteenth, this guide will help you make smarter decisions and unlock the full potential of private market investing.